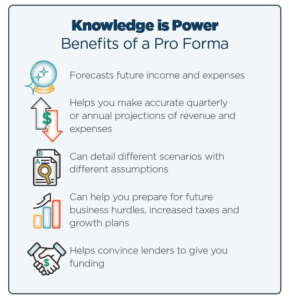

Whether you’re purchasing and renovating an existing vended laundry, or starting one from scratch, a Pro forma income statement is one of an investor’s most important tools in not only attaining financing, but understanding your business’ revenue and expenses projections. It helps you plan, predict, control and analyze the risks associated with your laundry’s funds. Moreover, it can highlight different scenarios related to equipment mix or services that might steer you in one direction or another.

Sometimes a Pro forma — which will become part of your loan application — is compiled by your equipment distributor. This can save you loads of time and is one of many reasons to partner with a good one. Your distributor should lead you in your Pro forma development and its submission to possible lenders. Your distributor’s local knowledge of the market and competition is essential to accurately forecasting everything: from turns per day and utility costs to establishing market-appropriate vend prices. Read on to learn more about the components of a Pro forma and why it’s so important …

The Precursor

By the time you compile a Pro forma, you and your distributor will have already performed a site analysis, demographic study and competitive analysis, and verified that your location is a good one. You’ll also have already received equipment and construction proposals and decided on the services you want to offer (wash/ dry/fold, drop-off dry cleaning, pickup and delivery).

Develop Multiple Scenarios

Build out your Pro forma to take into account different scenarios in terms of equipment and services. For example, you can run your Pro forma with more expensive soft-mount laundry equipment (high-speed washers and dryers) and with less expensive hard-mount laundry equipment. Even though the soft-mount machines might have a higher initial price tag, they typically save you considerably in utility costs over several years. For my customers, I run both equipment types as a comparison so it’s easy to see which is more cost-effective. Hands down, soft-mount machines save more money over time than hard-mount machines. Try the same thing with various services to see how they contribute to your bottom line.

Operating Expenses

The Pro forma includes totals of all foreseen operating expenses spread out over a number of years. That way, it’s simple to see the difference between month one and year three, for example. These expenses, or liabilities, include: equipment, rent, depreciation, payroll, labor, utilities, supplies for vending, taxes, insurance, vehicle expenses (with pick-up and delivery), fuel, and advertising, parts and service budgets.

Income Forecast

On the flip side, a Pro forma includes a forecast for income by service, for example self-service, wash/dry/fold, commercial laundry work, etc. This section calculates total anticipated income over a number of years. These revenue streams might include: self-service revenue based on vend prices and expected turns per day; full service wash/ dry/fold or commercial work based on anticipated customers per day and price per pound; and any other services, like pick-up and delivery, that might add to revenue.

Growth Forecast

Once again, your distributor is key in helping establish a growth forecast by month/year. Your Pro forma should illustrate growth based on educated projections.

Down Payment

Typically a $1 million venture requires 30 percent down. Your Pro forma includes this down payment and automatically calculates amortization financing schedules.

Double-Check Assumptions

Once assumptions are made, it’s important to check them over. Ensure your revenue, expenses and growth numbers look correct because this baseline data feeds your Pro forma, from which you’ll make decisions and seek financing.

Adapt and Use into the Future

In closing, keep in mind that a Pro forma can be adapted and used for years to come and aid you in making key business decisions. For, example: Is it a real benefit to add another revenue stream like full-service wash/dry/fold? How will a wage increase impact my bottom line? Should I add a flatwork ironer for processing commercial work? No matter how you look at it, developing a Pro Forma is a valuable tool that can be dynamically adapted into the future.

Download Article

Tod Sorensen is a regional business manager at Girbau North America and vice president of Continental Girbau West, a full-service distributorship serving the Southern California, Arizona and New Mexico vended, on-premise and industrial laundry markets. He holds more than 20 years of experience in vended laundry development and market analysis. Please contact him with any questions at tsorensen@gnalaundry.com or call 866-950-2449.